Environmental Accounting

Gustavo Tanaka

Environmental Accounting

Environmental accounting is a field in Accounting that aims at achieving sustainable development, maintaining a favorable relationship with the community, and pursuing effective and efficient environmental conservation activities. Environmental conservation is defined as the prevention, reduction, and/or avoidance of environmental impact, removal of such impact, restoration following the occurrence of a disaster, and other activities. The environmental impacts are the burden on the environment from business operations or other human activities and potential obstacles which may hinder the preservation of a favorable environment. (MOE, 2005)

Environmental Accounting – Classification

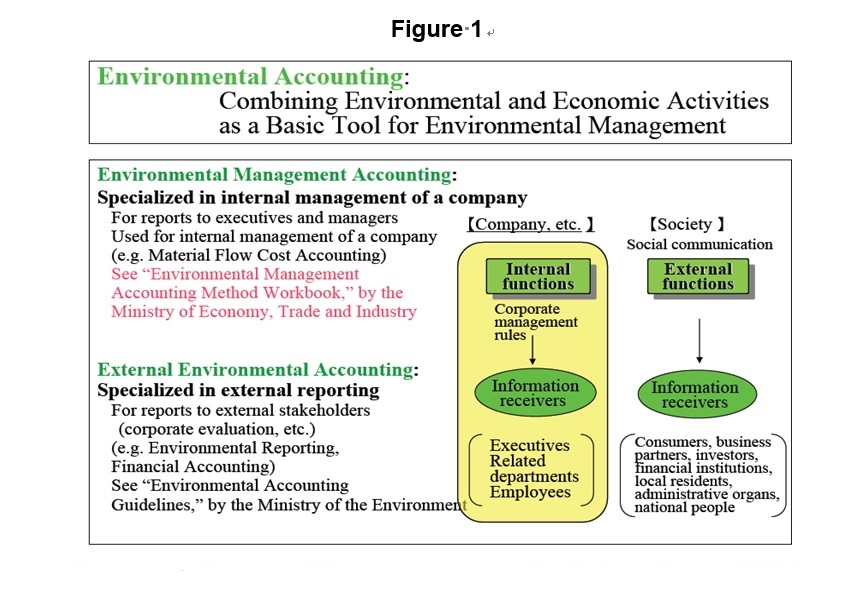

According to the Ministry of Economy, Trade and Industry of Japan (METI), Environmental accounting can be classified broadly into external environmental accounting -also called environmental, CSR or sustainability reporting-, in which information is disclosed outside of a company, and internal environmental accounting environmental -management accounting (EMA)- which contributes to business management within a company (METI, 2002). EMA has been well developed by METI in order to improve the environmental practices of companies while the Ministry of the Environment of Japan has focused more on the reporting side of environmental issues ?see Figure 1-.

The Japan Environmental Management Association for Industry [JEMAI] conducted EMA research between 1999 and 2002, supported by the Ministry of Economy, Trade, and Industry [METI]. The result of this research was published as the ‘‘Environmental Management Accounting Tools Workbook’’ in 2002. After completing this project, JEMAI established the Environmental Accounting Research Center in May 2003.

The MOE released the Guidelines for Environmental Performance Indicators for Business (Fiscal Year 2002 version) -a revised version of the Guidelines for Environmental Performance Indicators for Business- Fiscal Year 2000 version. This Environmental Performance Indicators Guideline is interlinked with the Environmental Accounting Guideline and Environmental Reporting Guideline also issued by MOE.

Environmental Management Accounting in Japan

In the last decades the Japanese government has made considerable efforts to develop environmental accounting being the Ministry of the Environment (MOE) and the Ministry of Economy, Trade and Industry (METI), the two leading institutions in this area. METI has focused on developing methods to enhance corporations’ environmental management accounting system presenting some methods in the 2002 METI’s EMA workbook

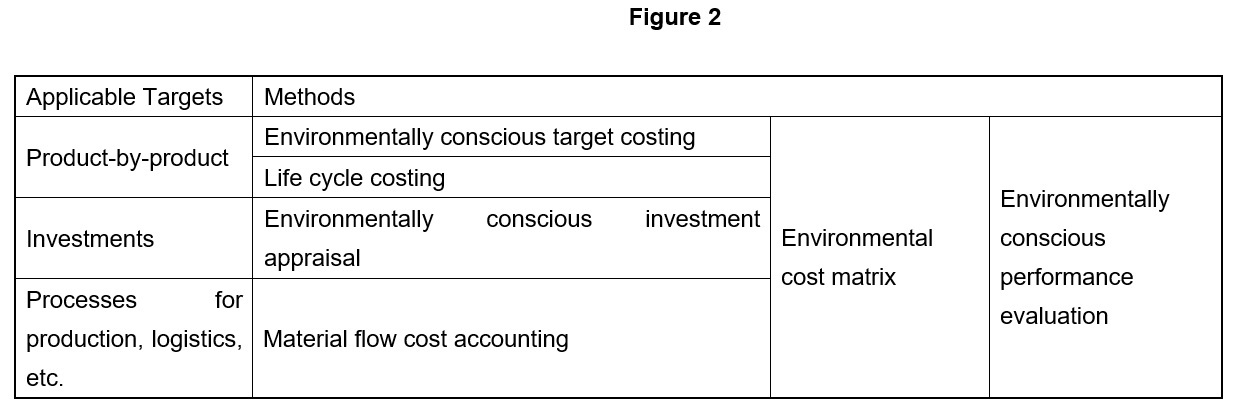

The methods are classified in the following five big categories. 1. Environmentally Conscious Capital Investment Appraisal 2. Environmentally Conscious Cost Management 2.1 Cost Calculations for Environmental Quality – Environmental Cost Matrix Method 2.2 Environmentally Conscious Target Costing 3. Material flow cost accounting 4. Life cycle costing 5. Environmentally Conscious Performance Evaluation: Environmental Performance and Corporate Performance Appraisal

In Figure 2, the methods and their applicable targets are presented.

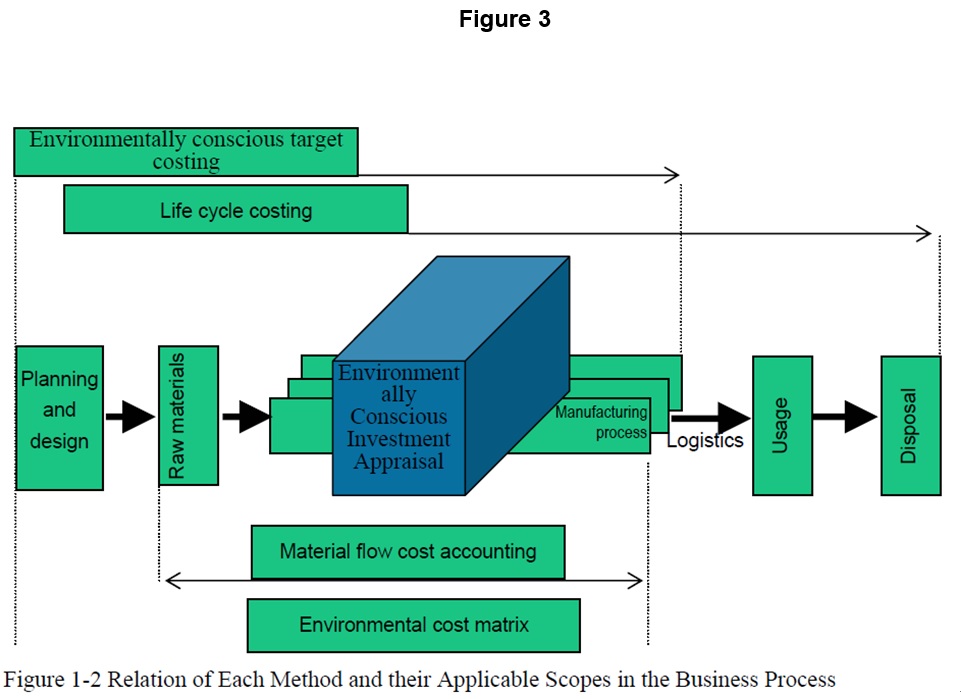

Although each environmental management accounting method is independent, there is a relation between them. Figure 3 schematize that relationship.

Material Flow Cost Accounting

MFCA has been developed in Germany as an EMA technique (Strobel and Redmann 2001, 2002). In Japan, METI launched a project in 1999 to promote EMA using a 3-year plan, in which Japanese companies were urged to introduce MFCA as the principal technique for EMA (see Kokubu et al. 2003). As part of this project, METI experimentally introduced MFCA in four Japanese companies (Nitto Denko Corporation, Tanabe Seiyaku Co. Ltd., Takiron Co. Ltd. and Canon Inc.).

Most companies that have introduced MFCA use it for a special cost study (Japan Management Association Consulting 2005) without using it continually as a corporate information system. However, by linking MFCA with their corporate information systems, some companies use it continually by incorporating it into their management control systems (i.e. the formal information-based routines and procedures that managers use to maintain or alter patterns in organisational activities) (Simons 1995, see also Anthony 1965 and Otley 1999).

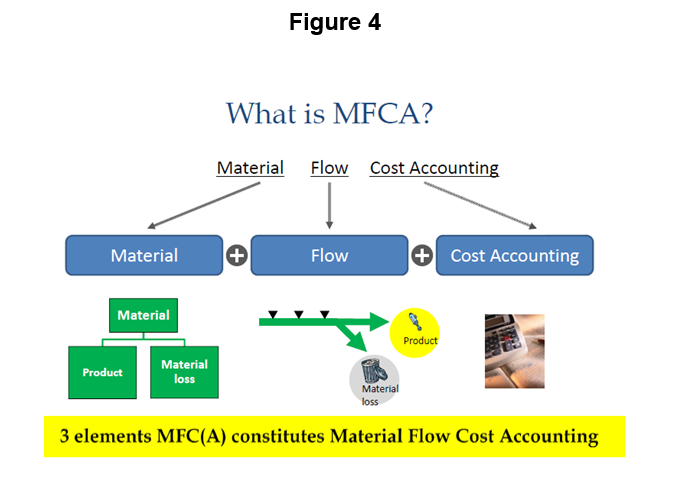

In conventional cost accounting methods, the emphasis is on the appropriate estimation of materials input into the factory or process. The physical amount of input materials wasted during manufacture is considered less important. This is because, if the costs of the raw materials that end up as waste were hidden in production costs, the company would not be able to identify the benefits of reducing wastes. In conventional cost accounting methods waste costs therefore tend to be systematically overlooked. Consequently, from the viewpoint of waste reduction, traditional techniques have their limitations. A variety of activities must be conducted if waste is to be reduced. It is unlikely that companies will embark on concrete waste reduction measures unless they know the extent to which this will benefit them. By measuring the cost of waste, something that conventional cost accounting often overlooks, MFCA helps to create concrete action plans for reducing waste and to make proposals for improvement measures. Waste reduction not only lessens the environmental impact but also reduces overall costs, including raw materials, processing and waste disposal costs. These reductions simultaneously result in both environmental conservation and financial benefits. Although MFCA is based on physical materials flow information, environmental impact assessment has not yet been integrated into MFCA so it is not a technique that can at present be used for calculating the full costs of the environmental burden, including social costs for externalities. However, companies can advance their environmental management in order to mitigate environmental impacts by using MFCA to find opportunities to reduce waste and improve resource efficiency.

Environmental, CSR or Sustainability Reporting

In order to share the “big picture” of the situation of the company, currently, companies communicate to their stakeholders using a diversity of forms including annual report (that contains the financial statements of the company) and sustainability reports (that depicts the social and environmental situation).

The GRI defines Sustainability Reporting as the process that assists organizations in understanding the links between sustainability related issues and the organization’s plans and strategy, goal setting, performance measurement and managing change towards a sustainable global economy ? one that combines profitability with social responsibility and environmental care. The final product of this process is a sustainability report where the organization reports on the most critical (or material) aspects of the organization’s economic, social and environmental impacts and the relation of those with its performance.

However, regarding the sustainability reports, companies entitle them using different names like Environmental, CSR or Sustainability Reporting.

Copyright 2017, Gustavo Tanaka